idaho child tax credit 2021

New Jersey Income Tax Calculator 2021. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year.

Have Questions About The New Expanded Federal Child Tax Credit Here S How It Will Work Idaho Capital Sun

Including the earned income tax credit and child and dependent care credit.

. If you are required to repay the credit because you sold the home or it otherwise ceased to be your main home in 2021 you must generally repay the balance of the unpaid credit with your 2021 return. Missing Advance Child Tax Credit Payment. Apply through your county assessors office.

Instead theyll use Kynectkygov. Under the American Rescue Plan the IRS will disburse half of the credit in advance as monthly payments rather than lumping the full credit amount into taxpayers refunds during tax season. Individual Income Tax Return Form IT-201 Resident Income Tax Return Tax Year 2021 IT-201 Department of Taxation and Finance Resident Income Tax Return New York State New York City Yonkers MCTMT 2 1 For the full year January 1 2021 through December 31 2021 or fiscal year beginning.

Call 208 334-2479 in the Boise area or toll free at 800 356. 2021 New Markets Capital Investment Credit. Visit taxidahogov and click on Income Tax Hub for more.

Minnesota has a state income tax that ranges between 535 and 985 which is administered by the Minnesota Department of RevenueTaxFormFinder provides printable PDF copies of 96 current Minnesota income tax forms. If you purchased your home in 2008 and claimed the first-time homebuyer credit you must continue repaying the credit with your 2021 tax return. You must be an Idaho resident to receive a grocery credit refund.

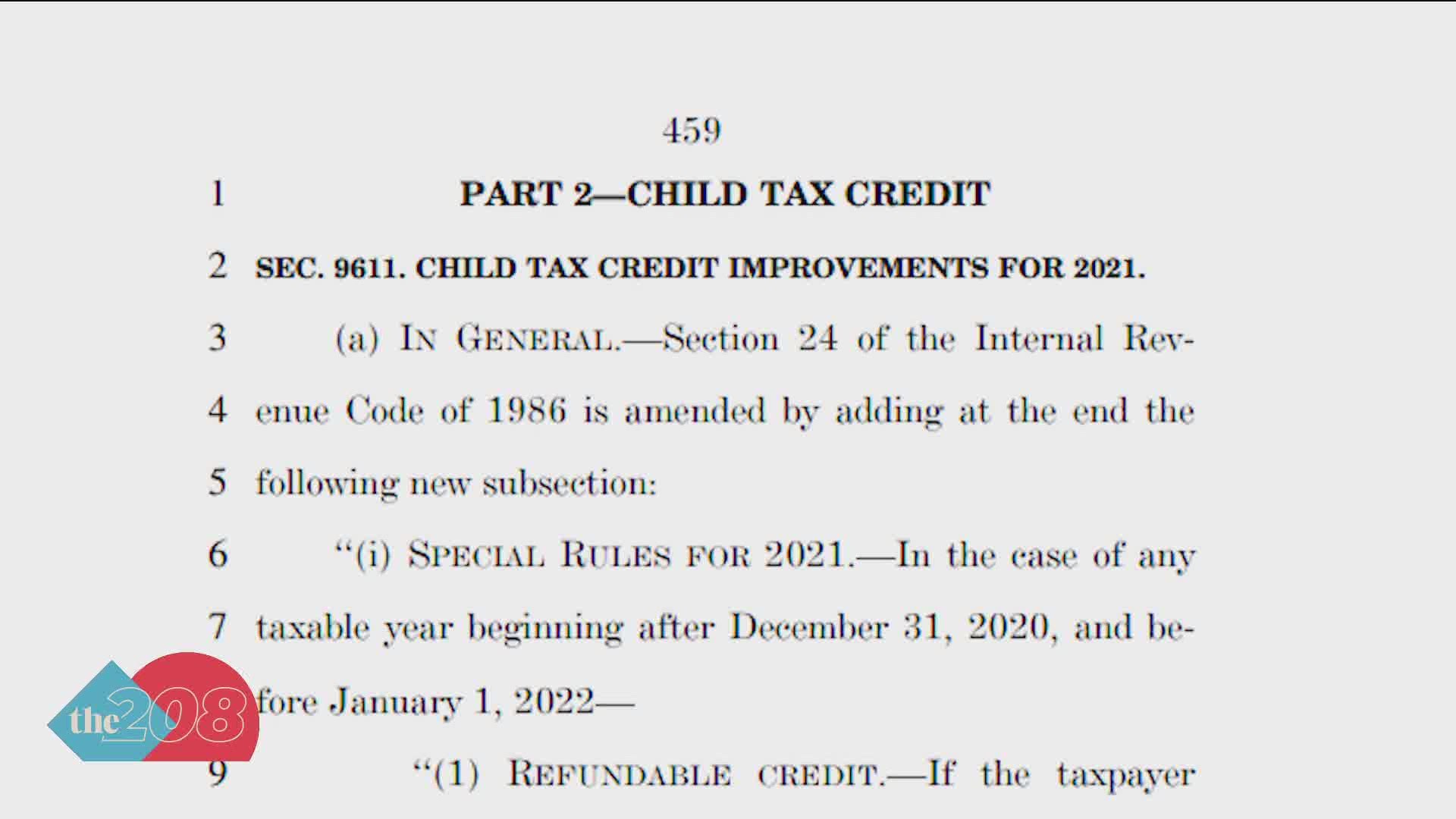

Idaho credits include the credit for income taxes paid to other states credits for charitable contributions and live organ donations and the grocery credit which is available to low-income taxpayers to offset Idahos sales tax on food. The child poverty rate jumped from 12 percent in December 2021 to 17 percent in January 2022 according to Columbia Universitys Center on Poverty. Child Tax Credit 2021 and Beyond.

2021 who qualify for the Child Tax Credit. The child tax credit has been extended to qualifying children under age 18. Tax Refund Estimator For 2021 Taxes in 2022.

2021 Partnership Request for Modification of Imputed Underpayments Under IRC Section 6225c Get 8980. New Markets Capital Investment Credit. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022.

Idaho Maryland New Mexico New York and several other states. Get 1041 Schedule K-1 8980. Self-Employment Tax Return Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico Tax Credit.

The CTC expansion alone kept 37 million children out of poverty in December 2021. Usually for unpaid child support. 2021 Minimum Tax Credit Worksheet.

You need to file valid 2019 and 2020 individual income tax returns by December 31 2021 to receive the rebate. Enter the number of Dependents between the ages 6-17 as of Dec. When elected officials let those reforms expire in January 2022.

On February 4 2022 Governor Little signed House Bill 436 that provides another tax rebate to full-year residents of Idaho. Tax Calculator 2021 Tax Returns Refunds During 2022. For TurboTax Live Full Service your tax expert will amend your 2021 tax return for you through 11302022.

Get Schedule 1-Wkst-Line 2k. New for this year taxpayers can donate their rebate back to the state. Get New Markets Capital Investment Credit.

In particular the expansion of the Child Tax Credit and Earned Income Tax Credit under the American Rescue Plan Act ARPA of 2021 dramatically decreased the number of families living in poverty. 205 for each qualifying child with Idahos nonrefundable child. Reconciliation of Premium Tax Credit Payments.

May 2021 National Occupational Employment and Wage Estimates. 31 2021 who qualify for the Child Tax Credit. That means theres limited.

Enroll for 2022 as soon as November 1 2021. Get Form 1040ME Schedule A Line 17. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10312024.

You can also contact your county assessors office or call us at 208 334-7736. Your Health Idaho is your states Marketplace. 31 2021 who qualify for the Child Tax Credit.

Enter the number of Dependents between the ages 6-17 as of Dec. Form 2441 - Entering Child and Dependent Care Expenses in Program. Southeast-Central Idaho nonmetropolitan area.

Terms and conditions may vary and are subject to change without notice. 2022 Property Tax Deferral Program 11-29-2021. For this 2022 tax year the money will be distributed as a single end-of-year tax credit per the previous program from the Internal Revenue Service IRS.

This reconciliation will be reported on your 2021 individual tax return. Find out if your state is planning to send out child tax credit money or offer deductions. If you and your spouse lived in a community property state you must usually follow state law to determine what is community income.

IRS Form 9465 - Installment Agreement Request - TaxAct. Child Tax Credit 2022 update Americans can get direct payments up to 750 but deadline to apply is just weeks away. Idahos metropolitan and nonmetropolitan area estimates.

2021 Kentucky residents will no longer enroll in coverage through HealthCaregov. Get answers to your tax questions by browsing through our most popular tax help topics. Before 2021 the credit was only available to individuals who reported AGI over 2500 which caused some of the lowest.

Since the 2018 tax year Idaho also has a nonrefundable child tax credit of 205 for each qualifying. Northwestern Idaho nonmetropolitan area. Made 200000 or less in 2021.

The Tax Commission and county assessors manage this program. Very soon if you received advance payments of the Child Tax Credit you will be required to reconcile the payments received between July and December with the total amount of credit you are eligible for in the 2021 tax year. The PTD brochure below has more information including how to file.

Check out our 2022 Tax Rebate video and find answers below to frequently asked questions about the tax rebate including how to donate your rebate. TaxActs support team offers all the tax and product support you need. Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin.

2021 who qualify for the Child Tax Credit. 2021 Income Modifications - Other Subtractions. Under ARP the child tax credit has been enhanced for 2021.

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Idaho Tax Rebate Checks To Be Mailed In Late March Klew

Idaho Residents To See Tax Relief Money As Soon As Next Week East Idaho News

Idaho Tax Rebate 2022 When Can You Expect Your Idaho Tax Refund Marca

Enhanced Subsidies Go Into Effect At Your Health Idaho April 1

The Numbers Who Gets Rebates Tax Cuts Under House Bill Local News Idahopress Com

Idaho Families Would Benefit From Move To Include More Children In State S Child Tax Credit Idaho Center For Fiscal Policy

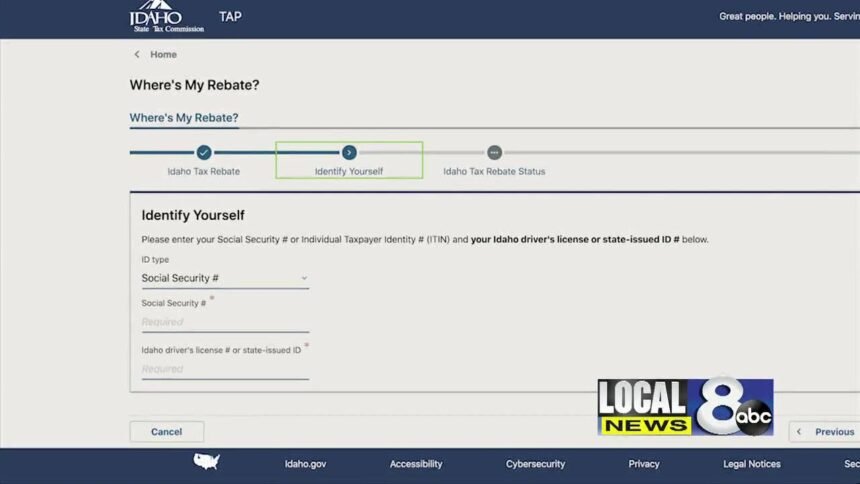

How To Track Your Tax Rebate Local News 8

Idaho House Approves Massive Income Tax Cut And Rebate Plan Ap News

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

10 Pros And Cons Of Living In Idaho Right Now Dividends Diversify

Idaho State Tax Commission Facebook

Idaho State Tax Commission Facebook

Idaho State Tax Commission Facebook

One Time Tax Rebate Checks For Idaho Residents Klew

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun